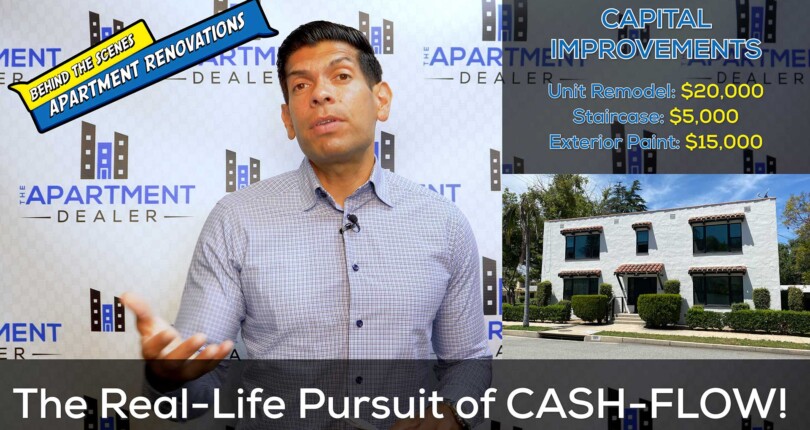

SoCal Apartment Renovation – Flip or Flop – Episode 3

Over the last few months I “Substantially Renovated” a 4 unit property in the Inland Empire. Having purchased the property earlier this year I had no idea I would be up against Rising Material Costs and an Extended Eviction Moratorium, but life goes on. On today’s show, I walk you through the final breakdown of how much I spent on the project, what improvements I chose to spend my money on, and the end result with respect to the increase in property value and, more importantly, the HUGE increase in Cash-Flow! This is the final installment in a 3 part series as I attempt to assist those owners who avoid property renovations because they assume the process is too much hassle, they do not have the “know-how”, fear that the process is too costly, or incorrectly assume the final payout does not justify the capital investment.