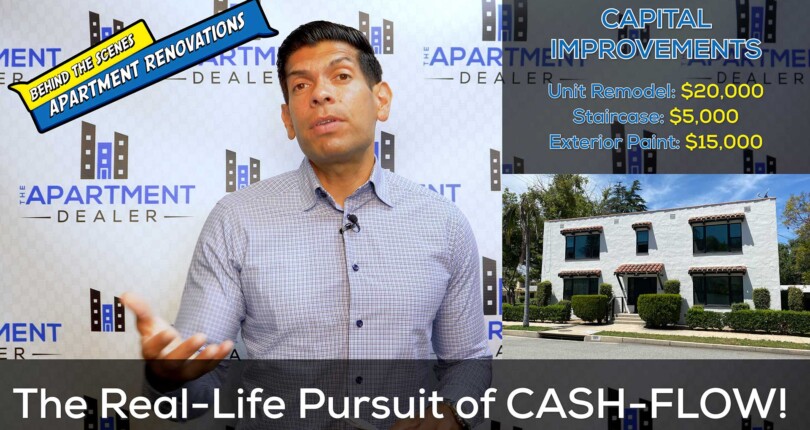

The Real Life Pursuit of Cash-Flow Part 4

Over the course of 2020, I embarked on a journey to “Substantially Renovate” an 8 unit property in the San Gabriel Valley. Having purchased the property in March of 2020, I had no idea I would be up against a Global Pandemic, Eviction Moratorium, and rising Material Costs. On today’s show, I walk you through the final breakdown of how much I spent on the project, what improvements I chose to spend my money on, and the end result with respect to the increase in property value and more importantly, the HUGE increase in Cash-Flow!

Watch now as I give you the financial breakdown of my most recent remodel project which consisted of vacating an entire apartment building…during COVID! Sounds scary I know, but the financial payout is HUGE!